CalKids

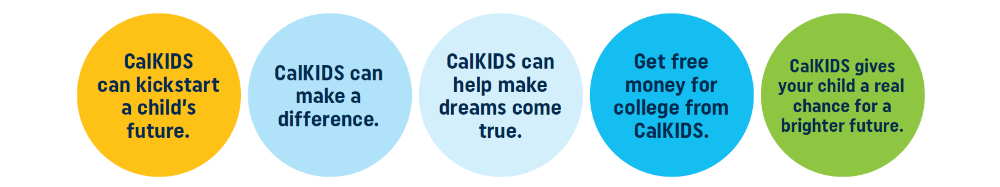

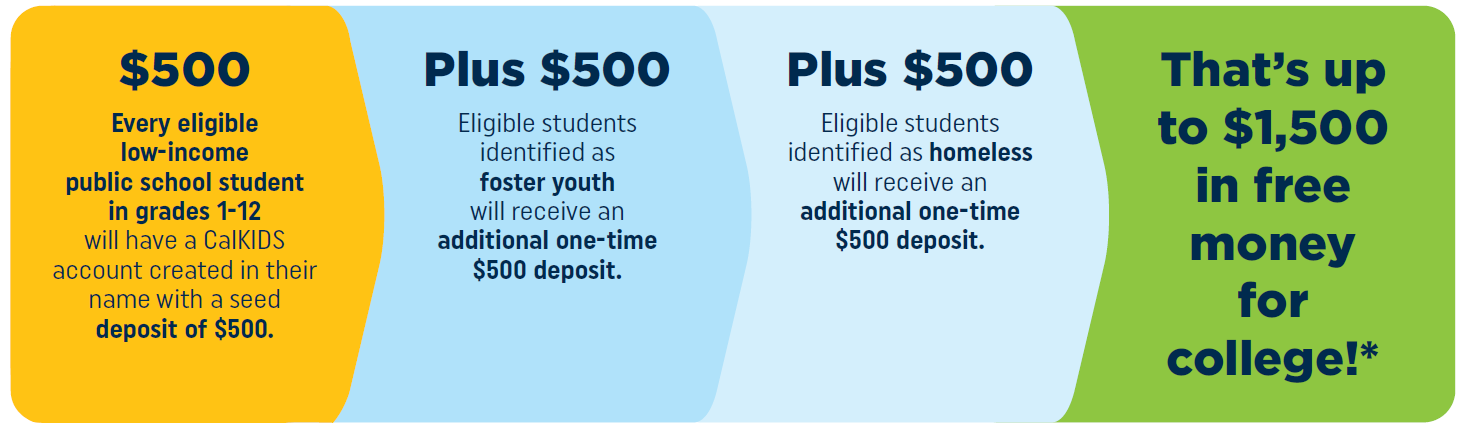

CalKIDS is a new program from the State of California, created to help families kickstart their college savings plan and increase access to higher education. This program provides eligible California public school students with up to $1,500 in free money for college.*

You can use these funds to pay for qualified higher education expenses, such as tuition, books, supplies, computer equipment, and certain room and board costs. Please consult with the financial aid office to help process CalKIDS funds.

CalKIDS is a children’s savings account (CSA) program administered by the ScholarShare Investment Board, an agency of the State of California that is chaired by the State Treasurer. CalKIDS will provide each child born in California and eligible low-income public school students with up to $1,500 in a CalKIDS account to help jumpstart their savings for higher education and career training!

Who Benefits?: Newborns and eligible low-income public school students (1st – 12th grade) are automatically enrolled and given a CalKIDS college savings account with an initial deposit (NO NEED TO APPLY)

$500 automatic deposit each academic year for eligible students (starting 2021-22)

$500 additional for eligible students identified as foster youth

$500 additional for eligible students identified as homeless

Account Registration Enrollment is automatic for eligible newborns and school-age students. However, parents or students will need to register online to access funds in their CalKIDS account. To register, the following is needed:

Newborns

- Child’s county of birth

- Child’s date of birth

- Local Registration Number found on birth certificate, OR CalKIDS code found on notification letter mailed to parent’s home

School-Aged Students

- County of student’s school as of Fall Academic Census Day (October 6, 2021)

- Student’s date of birth

- Statewide Student Identifier, which can be obtained by contacting the child’s school, OR CalKIDS code found on notification letter mailed to student’s home

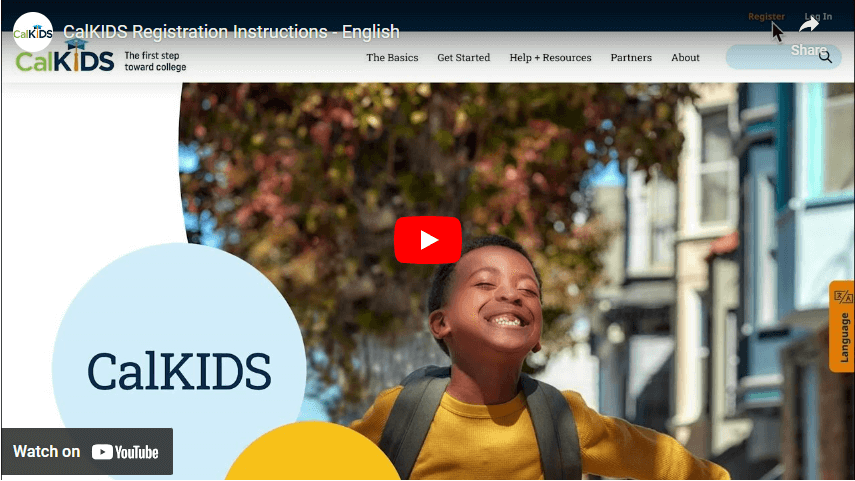

How to register for your CalKIDS Account

ScholarShare 529 Account

ScholarShare 529 serves as California’s official college savings plan. Administered by the ScholarShare Investment Board, ScholarShare 529 provides families with a valuable college savings tool, offering a diverse set of investment options, tax-deferred growth, and withdrawals free from state and federal taxes when used for qualified higher education expenses.

To open your 529 account in just 15 minutes visit www.scholarshares529.com

Request a Disbursement

The student must initiate a withdrawal from their CalKIDS account, withdrawals can be managed at CalKIDS.org. CalKIDS funds are sent directly to Cerritos College. Program participants must be at least 17 years old to request a withdrawal of funds. Participants have until they reach age 26 to use the funds in their CalKIDS account.

Once you request funds to be to be released to Cerritos College please allow 3-4 weeks for it to be processed and sent to your BankMobile Account refund preference.

Note: Students must have available financial need based off the Cost of Attendance in order to be eligible for disbursement.

If you have any questions regrading your disbursement please contact:

Veronica Castro

vcastro@cerritos.edu

562-860-2451 ext 3226

Eligible Use of Funds

Money in a CalKIDS account can be used to pay for qualified higher education expenses.

Examples

• Tuition and related fees

• Books and required supplies

• Computer equipment

Please note that funds used to pay for non-qualified expenses may be subject to penalties and/or taxes.

To learn more, visit calkids.org

Stay Connected