Information on 403b, 457 and ROTH

SchoolsFirst is the District’s third-party administrator (TPA) that ensures both the employee and employer are complying with the Internal Revenue Service rules/regulations related to this program.

All new deductions and/or changes to existing one must be sent directly back to SchoolsFirst for processing. SchoolsFirst will notify the Payroll Office accordingly. DO NOT SEND TO PAYROLL OFFICE

For assistance or questions, please call 800 462 8328 extension 4727 to speak with a SchoolsFirst representative.

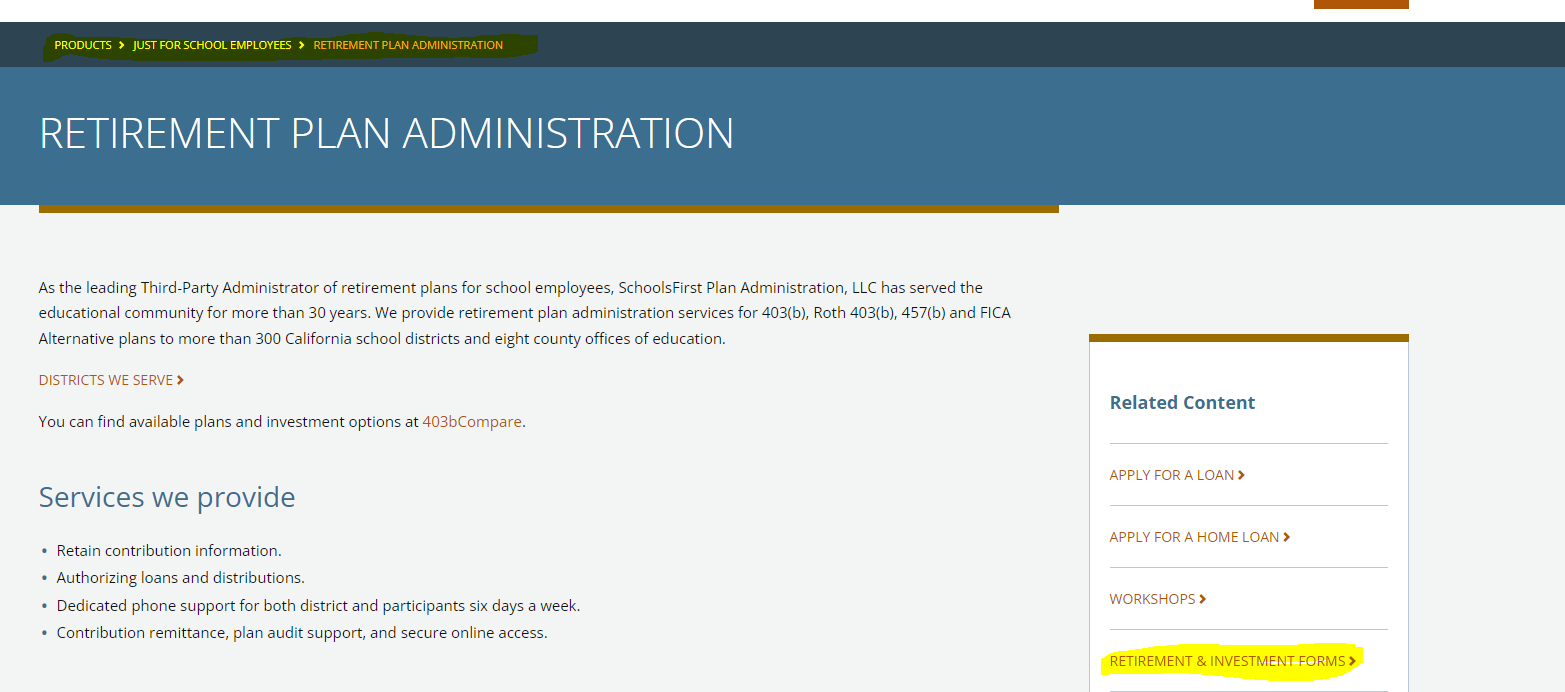

To start a new deduction and/or change and existing one, please click on the link below and follow the breadcrumbs

https://www.schoolsfirstfcu.org/

Planning & Investing > Just for School & Districts > Retirement Plan Administration > Retirement and Investment Forms

Stay Connected