How to Transfer Your IRS Tax Information on to the FAFSA

The IRS Data Retrieval Tool transfers your IRS tax information directly into your FAFSA. To use the Data Retrieval Tool, complete the following steps:

- Go to www.fafsa.ed.gov and select the “Start Here” button

- Log in using your FSA ID

- Select the “Continue” or “Make a Correction” button

- Select the "Financial Information" tab from the top of the page.

- Instructions for the parent or student to request the IRS information:

Go to "Parent Financial Information" or "Student Financial Information" page - Answer the questions in the first box to see if you are eligible to use the IRS Data

Retrieval Tool

If eligible, select which parent is providing information on the FAFSA or input student information - Enter the FSA ID for the parent providing the information

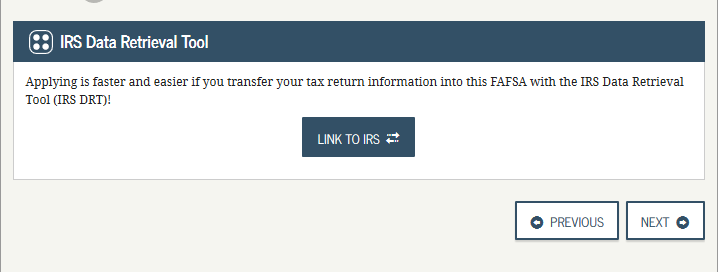

Click "Link to IRS"

Note: If both parent and student filed taxes you should use the IRS Data Retrieval Tool (DRT) for both.

See example of screen shots from the IRS Data Retrieval Tool.

Click "Link to IRS" d

d

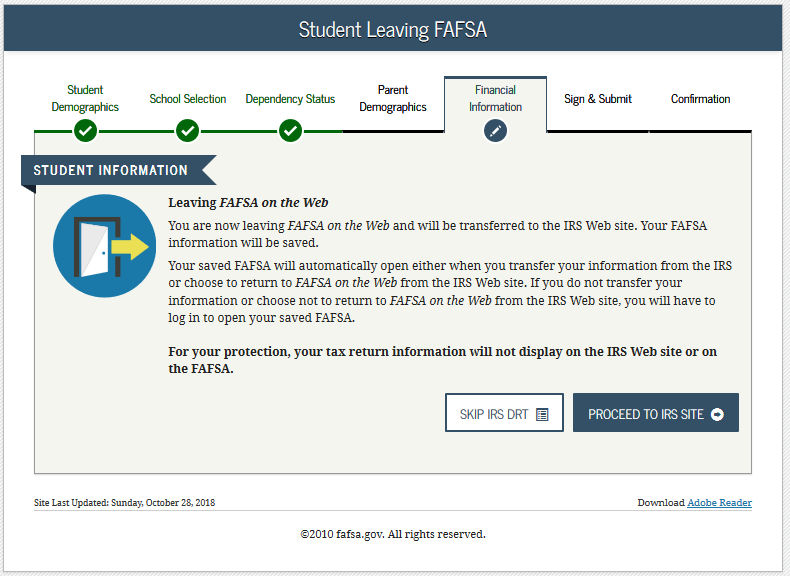

Click "Proceed to IRS Site"  d

d

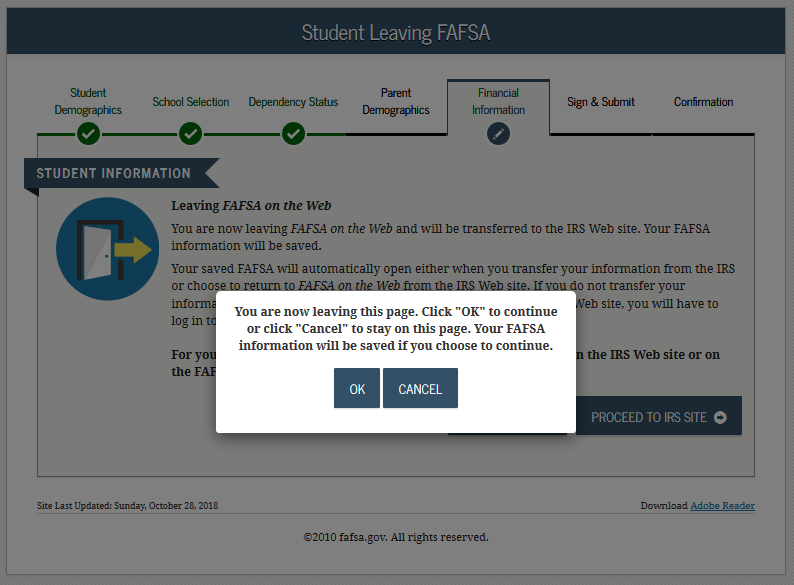

Click "OK" d

d

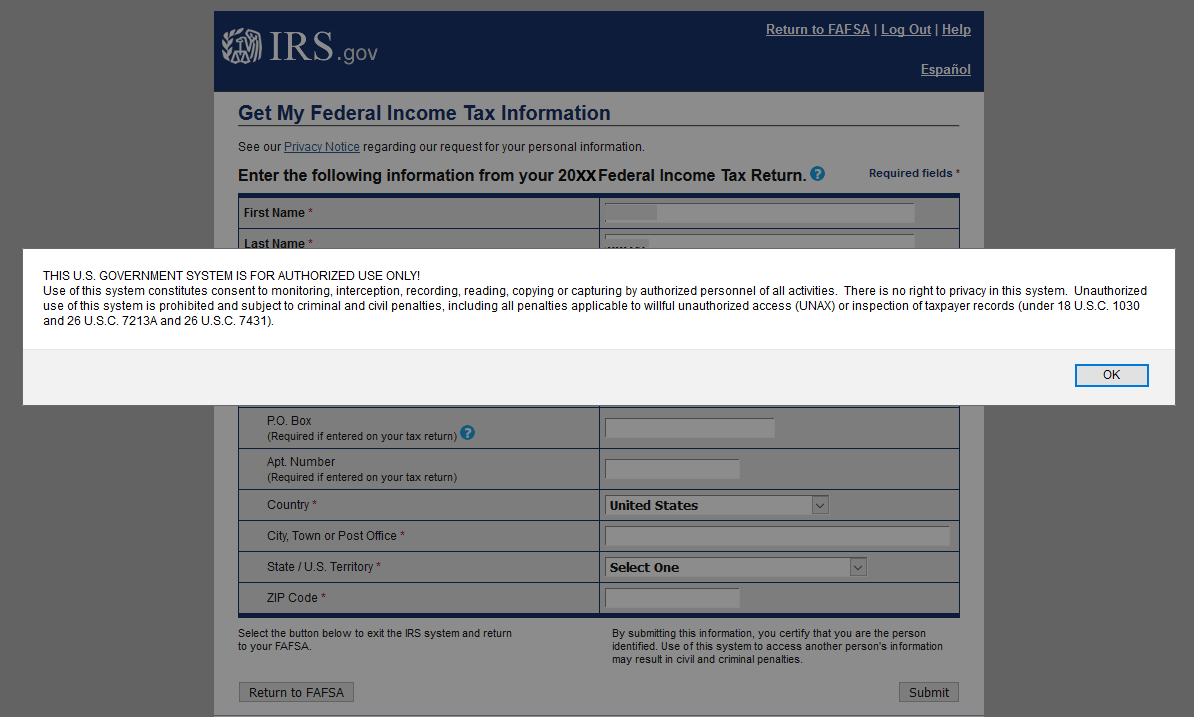

Click "OK" d

d

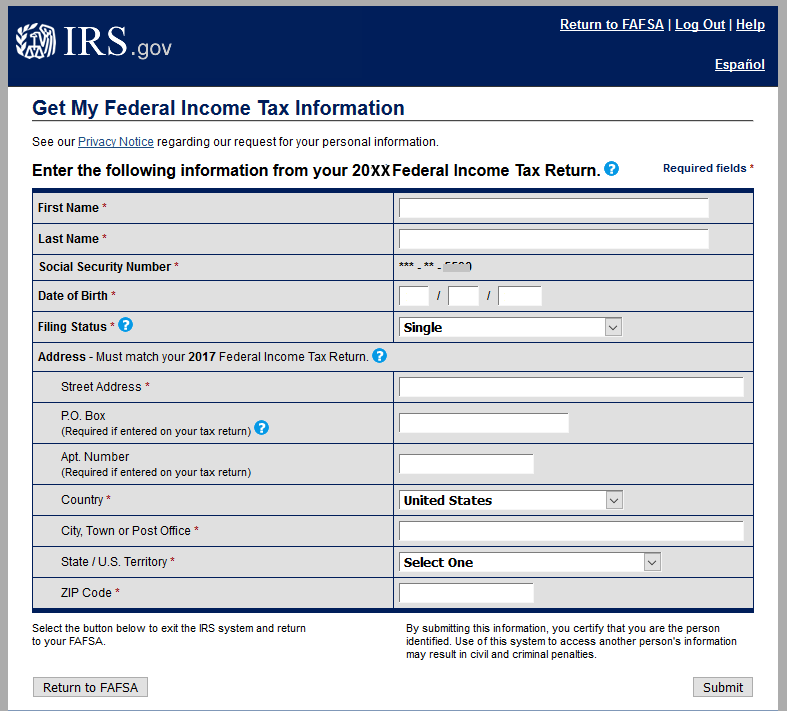

Fill in information and click "Submit"

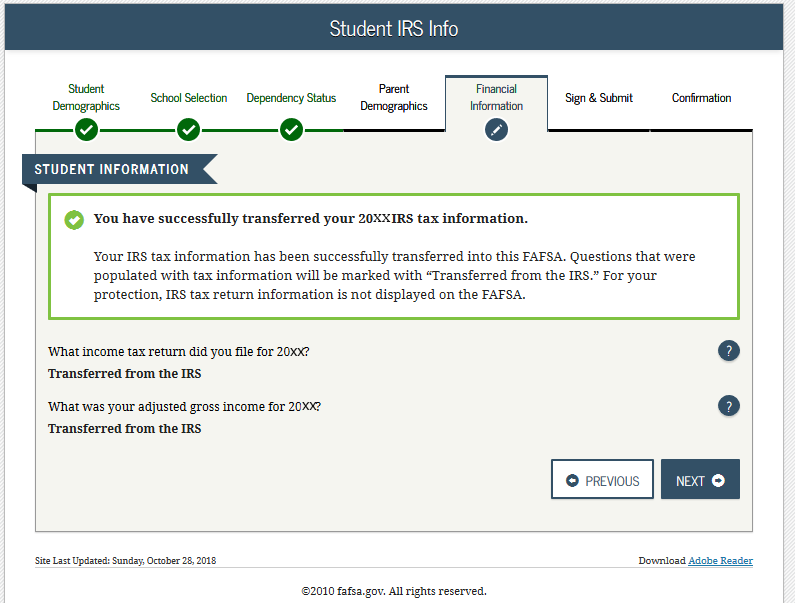

Click "Next" to continue

Proceed to the Sign and Submit page.

Note: For your privacy, the tax information you transfer from the IRS into your FAFSA form won’t be visible to you. Instead, you will see “Transferred from the IRS” in the appropriate fields on fafsa.gov, the IRS DRT web page, and on the Student Aid Report.

Go to WWW.FAFSA.GOV and compete these steps

If you need assistant with using the IRS Data Retrieval Tool visit the Financial Aid Office.

Stay Connected