Direct Loans

William D. Ford Federal Direct Loan Program

(Cerritos College does not participate in Direct PLUS Loans or Alternative/Private Loans)

Cerritos College offers Direct Subsidized and Unsubsidized Loans through the William D. Ford Federal Direct Loan Program. Students applying for a loan no longer need to select a lender. The U.S. Department of Education will be the lender.

Application will be reviewed and processed within 30 days. If your loan is denied you will receive a letter from the Financial Aid Office explaining the reason(s) for loan denial.

Students need to be actively enrolled in at least 6 units (half time) and meet all eligibility requirements to be considered for a loan(s).

Note: First-year, first-time undergraduate borrowers may be required to wait 30 days before receiving their first student loan disbursement.

2025-2026 Direct Loan Deadlines |

||

| Terms | Last Day to submit MPN/LEC* | Last day to accept/decline loans |

| Fall Only | November 7, 2025 | November 28, 2025 |

| Fall/Spring | April 24, 2026 | May 4, 2026 |

| Spring Only | April 24, 2026 | May 4, 2026 |

| Summer Only | June 1, 2026 | June 8, 2026 |

|

*Master Promissory Note |

||

2025-2026 Direct Loan Application is available July 1, 2025

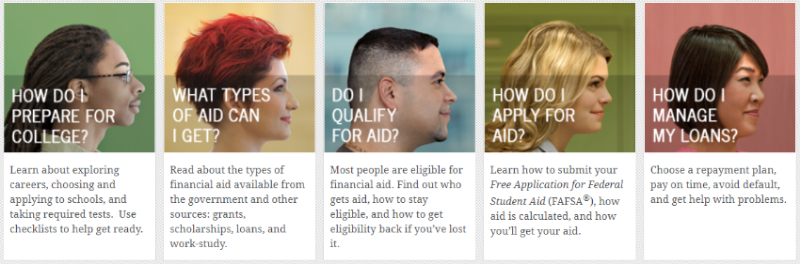

If you are interested in applying for a Direct Loan, please read and carefully follow the steps below:

Complete a Direct Loan Entrance Counseling (new borrowers only)

Complete Loan Agreement for a Subsidized/Unsubsidized Loan (MPN)

- The Loan Agreement for a Subsidized/Unsubsidized Master Promissory Note (MPN) is a legal document in which you promise to repay your loan(s) and any accrued interest and fees to the U.S. Department of Education. It also explains the terms and conditions of your student loan(s).

A disbursement will be processed for eligible students according to the disbursement schedule. You can check the status of your disbursements online at MyCerritos.

- Students must meet SAP standards to be eligible for disbursement.

- Loan disbursement cannot be processed unless you are officially enrolled in at least 6 eligible financial aid units and classes have begun.

- New loan borrowers must wait 30 days before they can receive their disbursement.

Complete a Direct Loan Exit Counseling

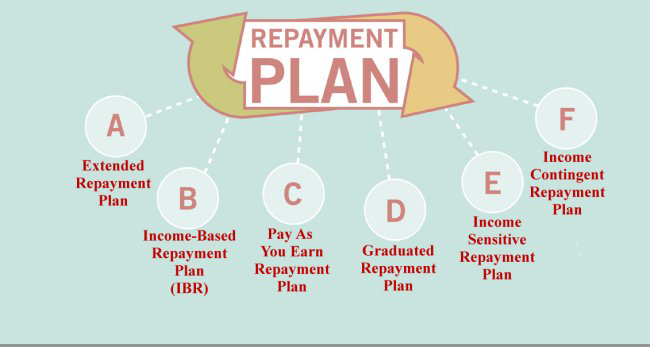

Manage Your Loan account: Setup your repayment Plan

Choose the right repayment option for you. It is important to setup and manage your

account with your loan servicer.  d

d

Repayment Estimator: When it comes time to start repaying your student loan(s), you can select a repayment plan that’s right for your financial situation.

Know What You Owe: The National Student Loan Data System has information about your federal student loans.

Create an account with your loan servicer:

Make online payments, view your account balances and payment history, change your billing options, enroll in electronic services and much more.

Not sure who your loan servicer is? Find out today!

| Loan Servicer | Contact |

|---|---|

| Edfinancial | 1-855-337-6884 |

| MOHELA | 1-888-866-4352 |

| Aidvantage | 1-800-722-1300 |

| Nelnet | 1-888-486-4722 |

| ECSI | 1-866-313-3797 |

| Default Resolution Group | 1-800-621-3115 |

Deferment and Forbearance Options

Having trouble paying your loan? Can't afford your loan payment?

Having trouble paying your loan? Can't afford your loan payment?

Notify your loan servicer if your unable to make your loan payment. You have options, the federal student loan program understands that things happen and don't always go according to plan you may qualify for a deferment or forbearance which temporarily stops or reduces your loan payment. Not paying your student loan can affect your credit so it is important to keep your loan servicer up to date. Avoidance is not the answer.

- In-School Deferment: Must be enrolled in at least 6 units

Cerritos College participates in the National Student ClearingHouse program and Admissions and Records will submit your current enrollment at the end of every month to the ClearingHouse. You can also obtain an enrollment certificate through your mycerritos account.

Learn more about the different options you have deferment and forbearance options and how to apply.

Contact your Loan Servicer today to see if you are eligible for any type of Deferment or Forbearance.

Grants and Scholarships

Before applying for a student loan consider searching for grants and scholarships. Reminder! All loans have to be paid back.

- Grants and Programs

- Scholarship Links

- On Campus Scholarships

- Cerritos College Foundation Scholarships

Stay Connected